Managing debt is one of the critical factors in staying financially healthy. It doesn't matter if it's a student loan, credit card debt, or a mortgage - keeping on top of them and figuring out smart ways to pay them can lead you to financial stability and peace of mind.

In this blog, we'll explore “Tipid Tips" - simple yet effective strategies to manage your debt like a pro. Plus, we'll look into how M Lhuillier's cash loan services can help you borrow responsibly.

Organizing Your Debt for Success #

Start by creating a detailed debt inventory. This involves listing all your debts, and specifying the amounts owed, interest rates, and due dates. Here are some tips for compiling this crucial information:

Use a spreadsheet for a clear overview

Include every debt, no matter how small

Note the interest rates, as they will impact your repayment strategy

With your comprehensive inventory, you can prioritize and organize your debts to formulate a realistic repayment plan. Consider these strategies:

Prioritize debts with higher interest rates to reduce the amount paid over time

Consider the snowball method for motivation, paying off smaller debts first

Set achievable milestones and celebrate progress to maintain motivation

Remember, managing debt effectively hinges on transparency and awareness. Be honest about your debts - track due dates and interest rates.

Budgeting for Debt Repayment #

Managing your debt starts with creating a budget. Here’s a simple plan:

1. Dedicate a Part of Your Income to Debt Repayment #

Decide on a chunk of your earnings that goes directly towards paying off debt. Setting up a direct deposit from your paycheck to a separate account for loan payments can make this easier.

2. Use Automated Payments #

To ensure you're always on time with payments, automate them. This way, you won't forget or have to do it manually each month.

3. Cut Unnecessary Expenses #

Review your monthly subscriptions and memberships. If you’re paying for things you barely use, like streaming services, gym memberships, or magazine subscriptions, cancel them. This can free up a decent amount of money.

4. Change Daily Spending Habits #

Small changes can lead to significant savings. Cook at home more often, make your own coffee, and use public transport. Stick to a shopping list to avoid impulse buys and look out for sales and discounts. Redirect the money you save towards reducing your debt.

5. Consider Loan Services #

Services like M Lhuillier’s can help you manage your debt more effectively. They can consolidate your debt, secure better terms, and lighten your financial load.

Unlocking M Lhuillier's Loan Services #

M Lhuillier offers a range of loan services designed to help individuals manage their debt. Whether you need quick cash, car, or home loans, M Lhuillier has your back! With competitive rates, flexibility in repayment terms, and an easy application process, M Lhuillier's loan services can help you confidently navigate your debt repayment journey. Explore your options below:

1. Quick Cash Loan #

M Lhuillier's quick cash loan offers a simple and fast solution for unexpected expenses such as medical bills, home repairs, or urgent payments.

With over 3,000 branches nationwide, the ML Quick Cash Loan stands as one of the most accessible and trusted lending services across the country. Offering the industry's highest appraisal and lowest interest rates, you're always assured of getting the value you deserve in every transaction.

a. Your Transaction is Safe and Secure

M Lhuillier prioritizes safety and security. Your collateral items are carefully packed and securely stored in a "safe within a vault," offering superior protection throughout the loan period. Furthermore, every M Lhuillier branch has closed-circuit television (CCTV), fire alarms, and advanced security monitoring systems, ensuring an impenetrable fortress for your valuables.

b. You Have Plenty of Collateral Options

You have a wide choice of collateral items, such as the following:

c. How to Avail

Apply in as easy as one, two, three! Simply present your items to the appraiser, submit a valid ID, and get your cash and pawn ticket!

2. Car Loans #

With M Lhuillier’s OR/CR Sangla, you can apply for a loan using the original copies of your vehicle’s Official Receipt and Certificate of Registration. Unlike traditional collateral-based loans, you won't need to surrender your vehicle, allowing you to keep your daily routine uninterrupted.

a. Guidelines and Parameters

Qualified - Locally employed, OFW, self-employed, pensioner

Acceptable Units - Second hand units except Korean, China, and Indian brands (Honda, Toyota, Mitsubishi, Isuzu, Ford, Suzuki, and Nissan)

Year Model - 2012 and up, provided not to exceed 10 years upon maturity of the loan

Amount of Loan - Up to 70% of appraised value of inventory being financed

Term of Loan - Maximum of 36 months

Manner of Payment - ML Wallet - free of charge

Other Charges/Deduction upon Release

Chattel Fee based on actual computation set by ROD and LTO

Comprehensive Insurance with AOG based on Insurable Value

Mode of Disbursement - Disburse thru our M Lhuillier branch

Collateral - Original OR/CR

Re-availment/Reloan - In case the outstanding balance is below six months, he/she can avail provided the unit will be re-appraised

b. How to Avail

3. Home Loan #

Consider M Lhuillier Home Loan for leveraging your property's value when you need additional funds. Ideal for first-time buyers or those looking to upgrade, this collateral loan allows you to use your TCT/CCT as security. Whether you're aiming to renovate, consolidate debt, or invest in more property, M Lhuillier offers competitive rates and flexible payment terms, making financial management easier while you capitalize on your assets.

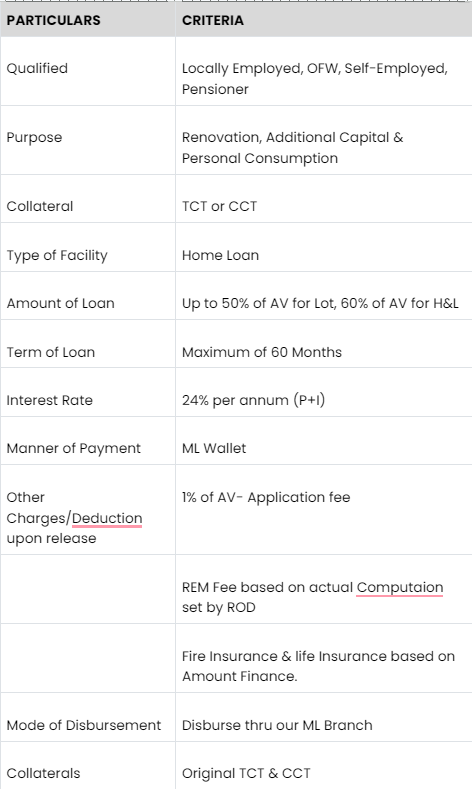

a. Guidelines and Parameters

b. Terms and Conditions

The client must submit Tax Declaration for Land & Building.

Original TCT or CCT

Original Tax Clearance

Sketch Plan

Certified True Copy of Title

Client must submit or endorse the Insurance Policy in favor to M Lhuillier.

Loan amount is 60% of the Appraised Value for House and Lot or Commercial.

Loan Amount is 50% of the Appraised Value for lot only.

Client must pay the appraisal fee of Minimum of Php 4,500 upon application

Pre-termination Fee is 3% based on Oustanding Balance.

Penalty Charge is 5% based on Oustanding Balance.

c. How to Avail

You may visit our nearest ML Branch and bring the following Requirements.

Tax Declaration, Sketch Plan, Tax Clearance.

Fill up the application form and wait for a call.

Responsible Borrowing Practices and Conclusion #

Managing your debt is critical to maintaining financial stability and achieving your long-term financial goals. By organizing your debt, creating a budget for debt repayment, and utilizing strategic tools such as M Lhuillier's loan services, you can take control of your finances and work towards a debt-free future.

Remember, responsible borrowing and proactive debt management are key to building a solid financial foundation. Start implementing these "Tipid Tips" today and take the first step towards financial freedom.

Need extra cash? Contact M Lhuillier today!

APPLY A LOAN HERE

M Lhuillier, the Philippines’ largest and most respected non-bank financial institution, continues to uphold its promise of being the Tulay ng PaMLyang Pilipino, with more than 3,000 serviceable locations nationwide. It continuously seeks better and innovative ways to serve its community by providing fast, easy, and reliable financial services such as Kwarta Padala, Quick Cash Loan, Car Loans, Home Loan, Bills Payment, Insurance Plan, Money Exchange, Jewelry, ML Wallet, ML Express, ML Moves, and Telco and online TV Loading.

Follow M Lhuillier Financial Services, Inc. on Facebook, or visit mlhuillier.com for more information. For inquiries, contact Customer Care through its mobile number +63-947-999-0337, +63-947-999-2721, +63-917-871-2973, +63-947-999-0522, +63-947-999-2472 or email customercare@mlhuillier.com.